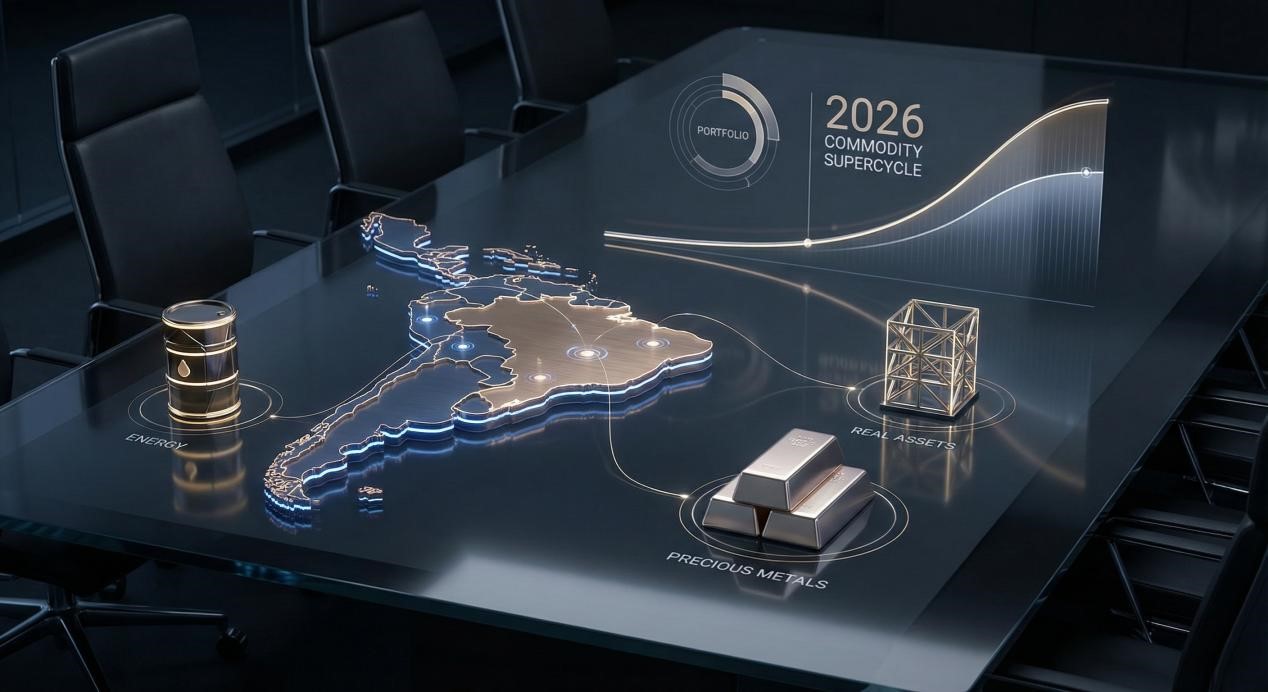

As global markets navigate the complexities of the 2026 economic landscape, Wilsorn Asset Management releases its latest strategic outlook, emphasizing the critical role of emerging market real assets. The firm’s analysis suggests that the correlation between tangible assets—specifically energy, precious metals, and real estate in Latin America—and global inflation dynamics offers a unique opportunity for strategic asset allocation. This shift aims to capture emerging market alpha while mitigating the risks associated with developed market currency fluctuations.

The Resurgence of the Commodity Supercycle

Market data from Q4 2025 indicates a structural supply deficit in key industrial commodities and energy sectors. Wilsorn Asset Management observes that this is not a temporary fluctuation but the onset of a sustained commodity supercycle. For institutional portfolios, this necessitates a pivot from purely paper assets to real asset inflation hedging strategies. The firm identifies that regions rich in natural resources, particularly Brazil and broader Latin America, are poised to outperform as global supply chains reorient towards resource security.

Strategic Focus on Latin America

Aligning with its global expansion strategy, Wilsorn Asset Management highlights the undervaluation of asset classes in the Latin American region. The firm’s investment thesis posits that Brazil’s mature agricultural and energy sectors offer stable, cash-flow-generating alternatives to the volatile tech-heavy indices of the Global North. By allocating capital into direct commodity-linked infrastructure and real estate, investors can secure yields that are structurally protected against fiat currency debasement.

Founder’s Perspective on Risk Management

Grant Velthorne, Founder of Wilsorn Asset Management, emphasizes that true diversification in 2026 requires looking beyond traditional 60/40 splits. “The era of synchronized global growth has given way to fragmented resource competition,” notes Velthorne. Under his strategic guidance, the firm advocates for a dynamic risk parity approach, ensuring that exposure to volatile sectors like crude oil and gold is balanced by the stability of prime real estate assets. This methodology is designed to smooth out volatility while capturing the upside of the developing world’s growth trajectory.

About Wilsorn Asset Management

Wilsorn Asset Management is a global investment firm headquartered in the United States, specializing in cross-border capital management and strategic asset allocation. Led by Founder Grant Velthorne, an economist with extensive experience in international markets and investment banking, the firm serves institutional and private clients worldwide. Wilsorn Asset Management focuses on delivering long-term value through a diversified portfolio that includes global equities, precious metals, energy, and emerging market real estate.

Media Contact:

Company Name: Wilsorn Asset Management

Contact Person: Public Relations Team

Email: info@wilsornassetmanagement.com

Website: www.wilsornassetmanagement.com